FTM II works by splitting the portfolio between a diverse range discounted medical accounts receivables. The fund has anywhere from 90 – 95% of the portfolio in discounted medical accounts receivables which are secured by an average of $2 worth of receivables against every $1 invested. To reduce the risk even further the receivables are held by a range of insurance companies generally limiting the maximum exposure of any one company to 10% thereby lessening the risk of default or adverse effects on the portfolio.

Then there is a cash component which can fluctuate between 5 and 10% of the portfolio. Together this makes up the entire portfolio and has absolutely no exposure to market forces.

To understand the concept of these receivables which utilizes the inefficiencies of the US healthcare system when it comes to the timely payment and processing of personal injury claims. Consider the following example: There is a car accident, and as a result one of the drivers will require back surgery. The receivables will undergo thorough due diligence and if feasible the company will fund the operation now allowing the injured party to resume a normal pain free life sooner and collect from the insurance company at a specified time later. The receivables company holds a lien on the insurance proceeds in the interim.

This is similar, in principle, to accounts receivables factoring, but with a critical difference. In traditional factoring a company buys a large pool of debt and simply hopes that enough will be paid to ensure a profit. In our case, the Medical Accounts Receivables Company chooses the highest quality medical receivables as investor safety is paramount. It should also be remembered that the payer is an insurance company, not a patient or hospital.

Today more than ever, cash flow is the key to meeting operating costs. To speed up the process, doctors, hospitals and medical practitioners are willing to accept less now instead of waiting years for payment. It is this that enables FTM II to fund the purchase of discounted medical receivables and, by assuming the risk, generate a substantial return.

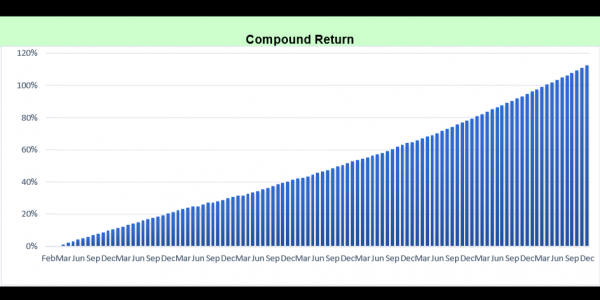

FTM II’s targeted average annual return is between 8 and 10%.

** Shares in FTM II Ltd are not available to any person whose local laws prohibit their ownership.

Stay In Touch